KY Bank M&A 2019

Bank Transactions and Acquisitions in Kentucky in 2019

Bank Transactions in Kentucky were much more active in 2019 than in recent years. There were 17 transactions that were closed or announced during the year not including the FDIC sale of Louisa.

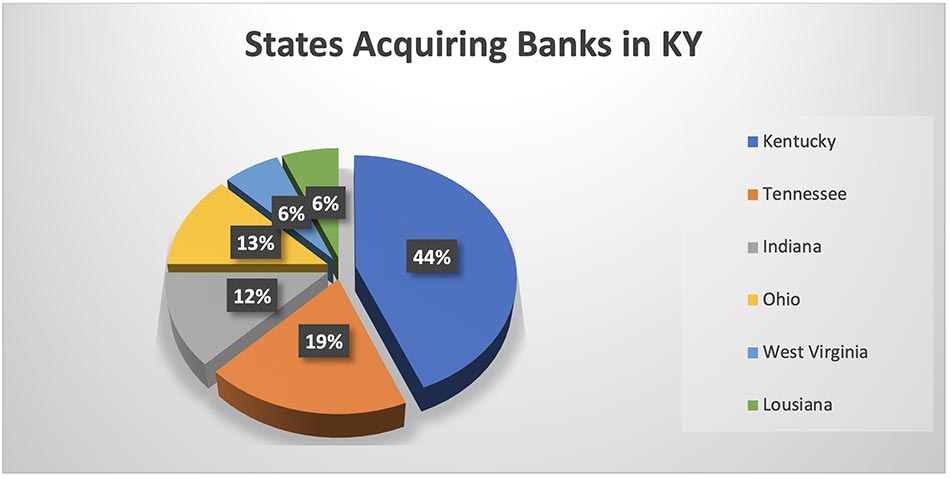

Four states bordering Kentucky took an active role in acquisitions this year. Less than half of the transactions were led by Kentucky banks or groups. Six states participated in the acquisitions this past year including the following with the number of transactions during the year illustrated.

| Indiana 2 | Louisiana 1 | Tennesse 3 |

| Kentucky 7 | Ohio 2 | West Virginia 1 |

Of the sellers, there were 15 banks, which included a mutual savings bank, a development bank, a wealth management firm and four bank branches.

Total assets of banks purchased in 2019 exceeded $3.1 billion. The sellers ranged in size from $26 million to $905 million. The average seller size was approximately $194 million in assets.

The buyers included 13 banks or bank holding companies, two mutual banks, a credit union and an investment group which formed a bank holding company. The buyers ranged in asset size from the smallest at $206 Million to $6 billion in assets with an average buyer size of $1.8 billion which continued the prior year ratio of 9 to 1, buyer vs. seller size.

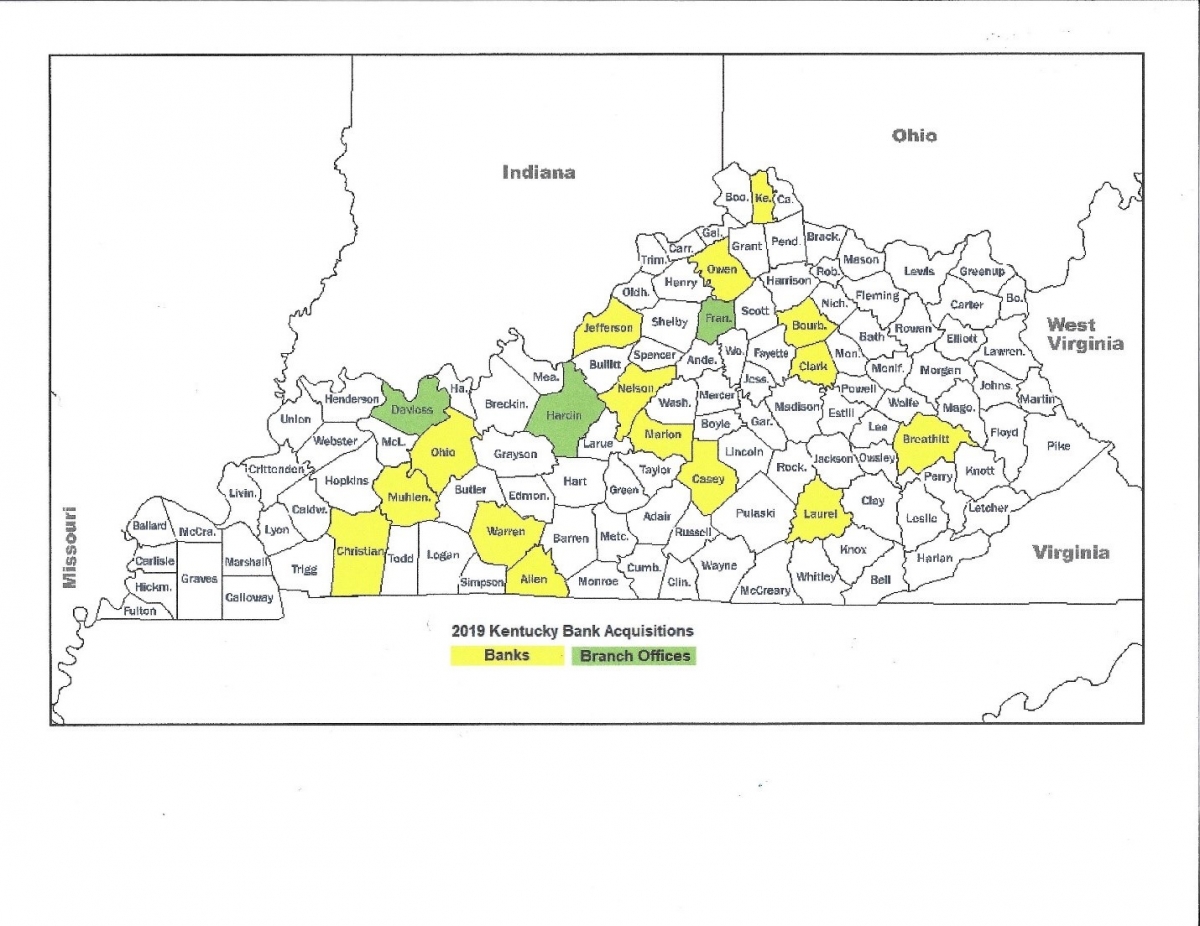

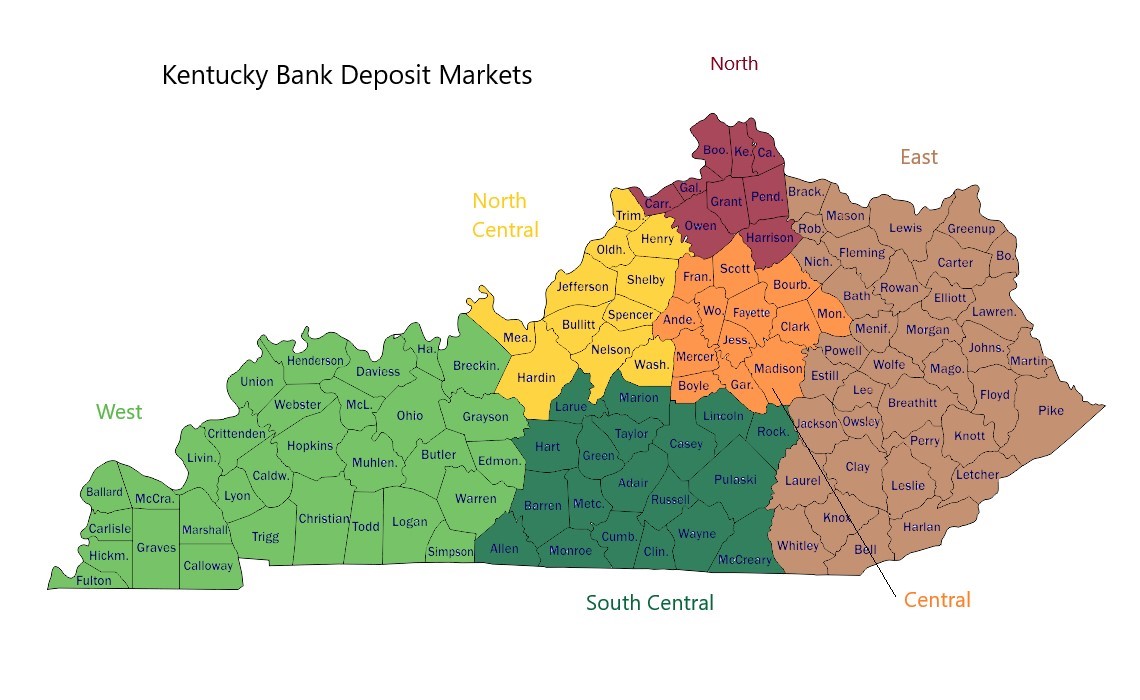

The acquisitions were in 18 different counties in the state. The geography of those counties involved was somewhat evenly dispersed in the state. (see Ky Bank Acquisitions and KY Deposit Markets maps)

| Northen Kentucky 2 | South Central 3 |

| North Central 3 | East 2 |

| Central 3 | West 5 |

Typically, the price of a transaction is not disclosed unless it involves a publicly traded institution. Of the transactions, there were only 6 that involved publicly traded companies. Those transactions ranged from a price to book of 1.87 times tangible book. Of those deals, the average multiple for the purchase was calculated to be around 1.39 of tangible book. If equity is normalized in the sellers at 9.00% capital, then that average multiple increases to 1.49 times tangible book. Further if you normalize equity at 8.00%, then the multiple increases to 1.55 times tangible book.

The average price paid in Kentucky was approximately 20 basis points below the national average and seems to indicate a buying opportunity for potential Kentucky bank acquirors.

Based upon Kentucky M & A activity in 2019, there appears to be even more interest in 2020 for further consolidation and acquisitions. Banks in Kentucky are apparently underpriced and therefore opening up opportunities for other more active acquirors out of state and a few in state to take advantage of a buying opportunity.

More discussions are taking place relative to the active acquiror role that some Credit Unions have adopted. There were no sales or mergers of Credit Unions in the state in 2019 however a state regulated credit union in Tennessee announced a bank acquisition in Kentucky. Time will tell how much of an active role credit unions will take in the acquisition process going forward in Kentucky and elsewhere.

Nationwide

- Nationally, whole Bank and Thrift M & A transactions were up slightly from prior year, 263 vs. 261 while aggregate deal values were up significantly from 29.7 billion to 58.5 billion or 97%.

- Prices were lower with price to tangible book dropping from 177% in 2018 to 159% in 2019.

- Price to long term multiple of earnings dropped from 25.0 times to 19.5 times.

- The average tangible book premium to core deposits was also down from 10.3% in 2018 to 8.9% in 2019.

- The number of branch transactions nationwide were down to 31 in 2019, the lowest point in at least 20 years however the premium for branch sales was at 5.1% the highest number since 2008.

These ratios were most likely influenced by the substantial growth in equity in banks and thrifts nationwide.

Sources: FDIC, S & P Global Market Intelligence